You have finally decided that it’s time to write your own Will. There are key appointments to be made, like the naming of an Executor, or maybe guardians for your children. But the main body of your Will is going to explain how you wish to distribute your estate (everything you own). This could be made up of a series of “bequests” to a number of “beneficiaries”. The selection of beneficiaries becomes a little more complicated for Expats, and we frequently receive questions related to who or what can be a beneficiary in the Will.

Copyright: andreypopov / 123RF Stock Photo

A quick word on Bequests

There are three types of bequest that can be included in a Will.

A fix sum of money; When your estate is administered, your Executor has to gather up your estate by collecting all of your assets including bank accounts and possessions. Out of this estate, your Executor will pay debts, funeral expenses and taxes. Once this is done, they move onto “specific gifts” which will include any sums of money. When you write your own Will you can include a specific financial gift (known as a “pecuniary legacy” in some countries). The advantage of this type of bequest is that it is quite easy for your Executor to administer, but there is one major disadvantage; you don’t know when your Will is going to some into effect. If your Will doesn’t come into effect for another 30 years, the value of this bequest will be significantly less than it was when you prepared the Will. To guard against this, you would have to update your Will on a regular basis.

A piece of property or “thing”. When you write your own Will you can also leave an object in your Will ranging from a collection of photographs to a cottage. If you own it, you can leave it in your Will to a beneficiary. There may be something of particular sentimental or financial value that you want to separate from the rest of your estate. Your Will is a great way to show your appreciation to friends and family members by designating them as the recipient of one of your possessions.

If you have left a specific item to somebody, and by the time you die you are no longer in possession of that item, the bequest is simply ignored. It is considered to be “adeemed“. Usually, the beneficiary doesn’t receive the equivalent value.

A percentage of your estate. Once your debts, taxes, funeral expenses and specific gifts have been paid out, you are left with your “residual estate”; everything else. Your residual estate usually goes to either a single beneficiary, or is divided between beneficiaries. For example, you could say that everything else is “divided equally between my three children”. Or you can leave “ten percent of my residual estate” to a person or organization. The final value of the bequest will be calculated by your Executor.

Who can be a beneficiary?

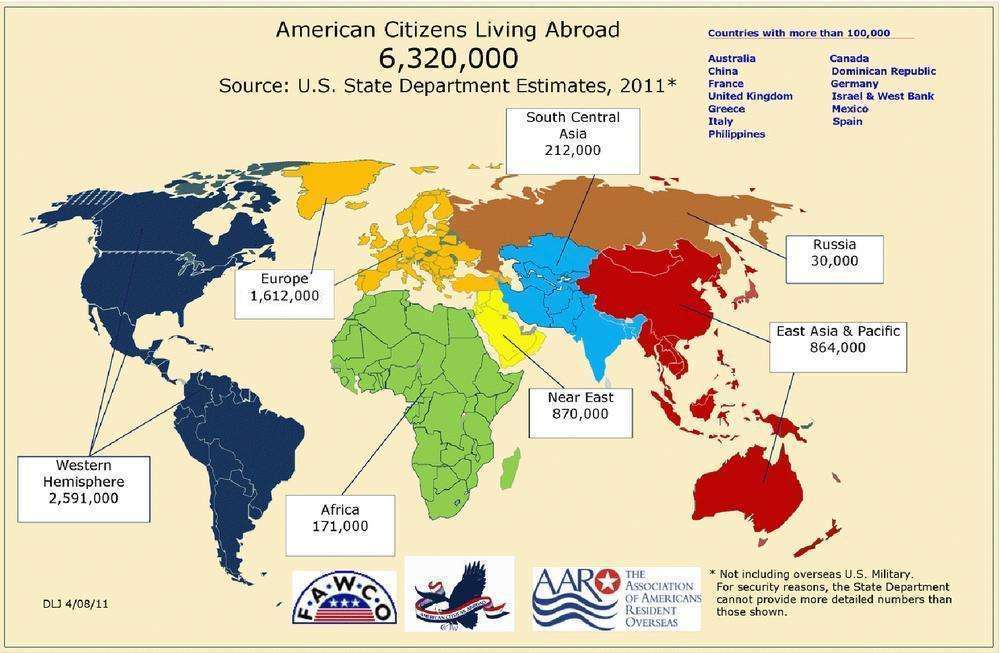

Family members no matter where they are in the World. One of the key considerations for Expats is that their family is often distributed around the World. There is absolutely no restriction on naming a family member as a beneficiary of your estate no matter where in the World they are living. Your Executor will have to track down the beneficiary, and make sure they receive their bequest.

Children. Any child can be a beneficiary in your Will, no matter what age, they just cannot directly receive their inheritance when they are a minor (under the age of majority). Typically you would set up a minor trust in your Will, and leave their inheritance in trust for them. Using the Wills at ExpatLegalWills.com you can specify the age at which you would like them to inherit. This can even be split so that they may receive say, a third at 21, a third at 25 and the remainder of their inheritance at 30.

Friends. A beneficiary does not have to be related to you in any way. Your Will is a great opportunity to recognise the impact that your friends have had in your life. There are some great stories of this, like this man who left 7 of his friends some money on the condition that they used it for a sightseeing (beer drinking) trip to Germany. It can actually be a very moving tribute to your life. When you write your own Will, make sure you unambiguously identify the beneficiary – “my friend Bob” probably won’t work.

Charities or organizations anywhere in the World. Of course, a beneficiary doesn’t need to be a person, it can be a church, charity, school, community group or scholarship. When you write your own Will with ExpatLegalWills.com we specifically prompt you to consider leaving a bequest to a charity in your Will (known as “planned giving”).

Who cannot be a beneficiary?

An animal. We hear these stories reported regularly. Leona Helmsley left $12M to her Maltese, Michael Jackson left $1M to his pet chimp Bubbles. In reality, most jurisdictions consider a pet to be the property of the owner, and one piece of property cannot own another piece of property. However, when you write your own Will many jurisdictions now allow you to create a “pet trust” where the proceeds of the trust fund can be used for the benefit of the pet.

This was reported quite recently with a woman in Bologna, Italy, who left an apartment to the stray cats of the city, at least, that’s what the headlines said. This article however goes onto explain “But the felines won’t actually be getting their paws on the home. Scannabissi’s Will states that the local council should sell her home – after which all proceeds will go to the city’s cattery, Trebbo di Reno, which looks after Bologna’s strays.”

A witness to the signing of the Will. This is the most important consideration when you write your own Will and step through the signing process. A witness to the signing of the Will cannot benefit in any way from the contents of the Will. Most jurisdictions also disqualify the spouse of a witness from being a beneficiary (or the spouse of a beneficiary being a witness). The witness is certifying that the testator (person making the Will) is signing their Will with no undue influence, has capacity to sign it, knows what they are doing, and are not being pressured of coerced. Clearly there is a conflict of interest if the witness is also a beneficiary. At best, the witness will simply forfeit their bequest, at worst, the whole Will may be overturned.

You cannot break the law. This issue came up recently in Canada in the case of “the racist Will” which was overturned by the courts. The initial reaction was based on the belief that everybody has the freedom to do whatever they wish with their Will, but in fact you still cannot break the law. In this case, the judge determined that the Will was racist, and so broke Canada’s laws written into the Charter of Rights and Freedoms. But it goes beyond this. You cannot for example leave a bequest to a terrorist organization, promote hate speech, or do anything in your Will that would be illegal while you are alive.

The “Slayer rule”. Okay, this one is a stretch, but for sake of completeness. The slayer rule, in the common law of inheritance, prohibits inheritance by a person who murders someone from whom he or she stands to inherit (e.g., a murderer does not inherit from parents he or she killed). However, just to be clear, simply being convicted of a (unrelated) crime, or serving time in prison does not disqualify somebody from receiving a bequest.

Who must be a beneficiary?

So now you know who can and cannot be a beneficiary, you need to consider who must be a beneficiary when you write your own Will.

A spouse or minor child. This is different from country to country, State to State and Province to Province. But generally speaking a spouse can make a claim on an estate if they have been disinherited. For example, in British Columbia there is the “Wills Variation Act” which protects the rights of a spouse or child to make a claim on the estate. There is an excellent overview here.

Adult children. We are seeing more frequent cases of adult children making a successful challenge to a Will. In the UK there was a landmark ruling which granted an adult child based on the Inheritance (Provision for Family and Dependants) Act. In many jurisdictions there is no issue with disinheriting your adult children, but if you decide to write your own Will, and are planning to disinherit your children, you may want to seek legal advice.

Dependents. Most jurisdictions allow a dependent to claim something from an estate. This claim is not restricted to immediate family members, but anybody who can demonstrate that they are dependent on you, can make a claim on your estate. In the age of mixed, blended or step-families, this is an important consideration.

What if you don’t have a Will?

If you don’t have a Will, the process for probating and administering your estate is more complicated, but the distribution of your assets is usually quite simple. The local laws determine who will receive what percentage of your estate. There are some key implications of this;

Your spouse will probably not automatically receive everything. This is one of the most common misconceptions of dying without a Will. If you have children, your spouse and children will split your estate in proportions dictated by local laws. There are very few jurisdictions that leave everything to the spouse, even if your children are babies or toddlers.

You will not be able to specify which items go to which people. You estate will be divided by percentages. Which probably means that everything will be sold off to establish an estate value. The beneficiaries will then receive the equivalent cash total for their percentage of your estate.

No organization will receive anything. When you die “intestate” you lose the opportunity to leave somebody to a charity or community group. In fact, without a Will nobody other than an immediate relative will receive anything. If you have no immediate relatives, then everything you own will go to the government.

Why you should write your own Will

If you write your own Will using a service like the one at ExpatLegalWills.com, you get the opportunity to be creative with the distribution of your estate. Firstly, we prompt you to consider charitable bequests. You can then leave an unlimited series of specific bequests of money, things or percentages of your estate.

The great thing about an online service like ours is that you can then update your Will at any time, at your own convenience. If somebody becomes a positive influence in your life, you can quickly add them as a beneficiary of your estate.

If you start to have dealings with an organization like a hospital, or charity, you can quickly login to your account, and add a quick bequest. No appointment with a lawyer is necessary; add the bequest, print your new Will, sign it in the presence of two witnesses, and you now have a Will that reflects your current circumstances.

The important take-away is that you need a Will. It’s your opportunity to let people know how important they have been in your life. And don’t make do with a Will that is 20 years old. Your Will is your legacy, don’t waste the opportunity.

- Am I too young to write a Last Will and Testament? - May 25, 2017

- Confused about Wills? Unusual expressions demystified. - July 21, 2016

- How to write a legal Will – the signing process - May 20, 2016