Although estate planning can be easy and intuitive, the legal jargon surrounding Wills can make it confusing for those who aren’t familiar with the process. Although many aspects of estate planning are actually relatively simple, the unfamiliar language that people associate with the law can make these aspects seem daunting, even unintelligible. The awkward words used in Wills may be intimidating, but you shouldn’t let a few unusual terms turn you away from preparing your own Will.

One of the philosophies that governs ExpatLegalWills.com is the idea that the law should be accessible, and that jargon terms shouldn’t prevent anyone from understanding their Wills. You shouldn’t be required to spend significant sums of money on legal advice just to understand your own Will. This glossary presents some of the most common terms that surround estate planning law, terms that will be useful as you write your Last Will and Testament. If there are others you would like to see, please add them in the comments.

Ademption:

If you leave a specific item in your Will to a beneficiary, but no longer own this item at the time of your death, it is said to be “adeemed”. This means that the item is no longer a part of your estate and your Executor cannot give it to your beneficiary. For example, you wrote in your Will in 2010 that you wanted your nephew to receive your Porsche Carrera, but you sold it in 2011. This bequest would be “adeemed” meaning that your nephew doesn’t receive the Porsche, nor does he get an equivalent.

Administrator:

Somebody has to carry out the instructions in the Will. If you name a person as your Executor in your Will, then this person has the authority from the courts to take care of your estate administration. This is usually done by giving the Executor a “grant of administration” which the banks and other financial institutions accept as validation of the Will and Executor.

If nobody is named in the Will as the Executor, or there is no Will (you have died “intestate”, then the courts will appoint somebody as the estate administrator. The estate administrator or the Executor is also sometimes called the “personal representative”.

Affidavit:

If somebody challenges your Will, a judge may ask your witnesses to swear under oath that there was nothing inappropriate about the signing procedure. Many jurisdictions including some US states allow you to take care of this proactively. Your witnesses can sign an “Affidavit of Execution” in the presence of a Notary. This has them swear under oath at the time of the signing of the Will that everything was conducted correctly. Some people call these “self-proving” Wills.

Beneficiary:

You name beneficiaries in your Will as a person or organization who will receive an asset from your estate. This could include inheriting property, receiving a specific item like a piece of jewelry, or receiving a bequest of a sum of money. If it very common to include charities as beneficiaries in Wills through the act of “planned giving”. Another word for beneficiary is an “heir”.

Bequest:

A property transfer or gift included in Wills. Also called a legacy. There are three types of bequest. A specific item, for example, a car, or a piece of jewelry. Bequests can also be a sum of money that can go to an individual or a charity. Finally, a bequest can be a percentage of your estate. It is very common for example to leave an estate in equal shares to children, who would each receive a fraction.

Codicil:

It is always a bad idea to write changes onto a Will directly onto the document. If you do this, somebody could challenge your Will based on a claim that somebody else had made the edit on your behalf. To avoid this you should re-write your Will if any changes are required. Historically, this would be a tedious task if the changes were relatively minor, so rather than re-typing the Will, the will writer would prepare a new document that referred back to the original describing the changes. The document would then be signed in the presence of two witnesses and attached to the Will.

This appended document is a codicil.

In modern times, with the ubiquity of computers and printers, codicils have become a relic of a bygone era. They can cause confusion and you should avoid writing a codicil.

Contest:

Used as a verb, the process of disputing Wills after the passing of the testator. There are very specific reasons why a challenge to a Will can be successful. Somebody would need to prove for example that you didn’t have the mental capacity to prepare your Will. Or that you were unduly influenced to sign something that you didn’t want to sign.

Simply being left out of a Will is usually not a good enough reason to contest a Will unless you are a spouse or a dependent. Although there are exceptions, most jurisdictions do not require you to leave something in your Will to all of your adult children.

Duress:

Not acting out of your own free will because of extenuating circumstances or interference from others. Most countries require you to sign your Will in the presence of two adult witnesses. The role of these witnesses is not to check the contents of the document, but to verify that you were signing the document without any undue influence. Particularly from beneficiaries.

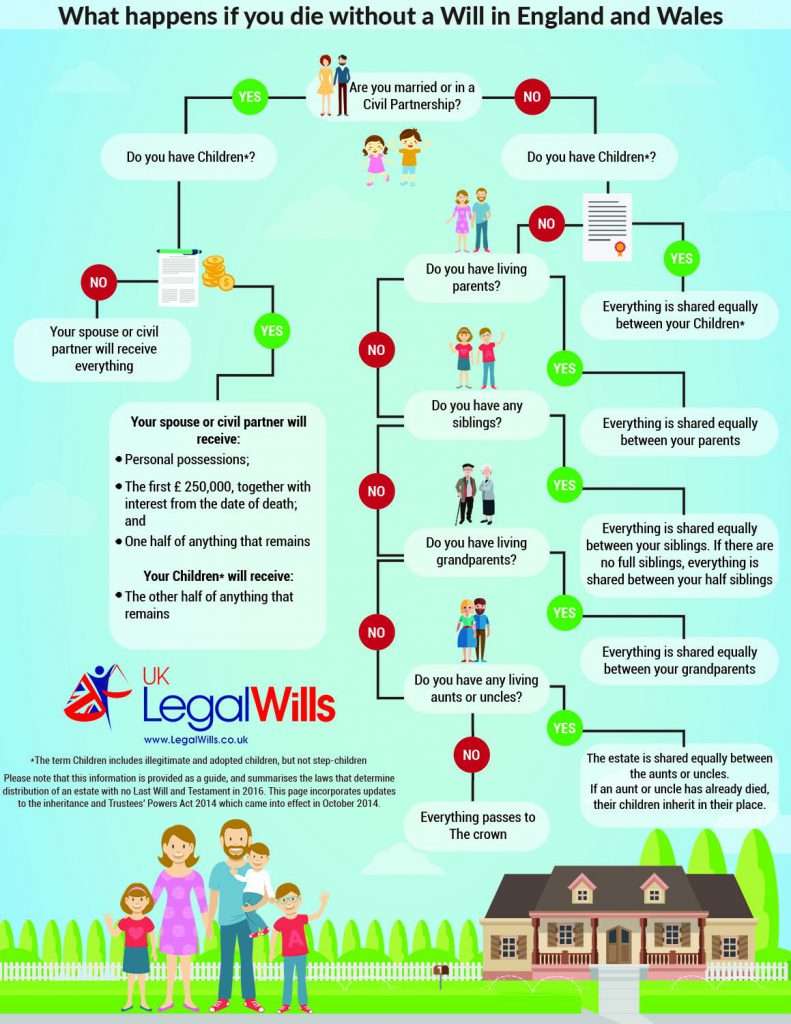

Escheat:

If you die without a Will, you are said to have died intestate. Each jurisdiction has a formula for how your estate will be distributed. Contrary to popular belief, it rarely all passes automatically to your spouse. There is an order of inheritance, usually starting with the spouse and children, then parents, siblings, grandparents, aunts and uncles. If there are no relatives then everything passes to the state (or government). The process by which an individual who dies without heirs and everything passes to the state is called “escheat”.

Estate:

The property owned by the “testator” at the time of death. The distribution of your estate is one of the most important functions of Wills. When most people think of an “estate” they think of a mansion with acres of grounds. But everybody has an estate. An estate can simply be your bank account.

Executor:

The person responsible for carrying out (executing) your instructions in your Last Will and Testament after your death. Generally any friend or family member can serve as the Executor. You can also name a law firm and some banks offer the service. But you should watch for the fees charged by professionals, as it is usually a percentage of the estate, on top of hourly fees.

Guardian:

A person appointed by the testator to look after children below the age of majority in the event of death. In practice, if both parents die, then the courts will decide who will take over guardianship. Hopefully some people put themselves forward as candidates and a judge will make a decision with the information presented to them. If an appointment is made in the Will, and this appointment is willing and able to assume the responsibility, then the judge would typically grant guardianship of the child to this person named in the Will.

Inheritance:

If you receive something from an estate; either a bequest or a legacy. Then this is your inheritance. Different countries have different laws regarding the taxation on this inheritance.

Intestate:

Not having a Will. Dying intestate will usually involve the courts and the government distributing the estate based on a standard formula rather than based on the wishes of the person who passed. A common misconception is that everything automatically passes to your spouse. However, depending on whether you have children, and the size of your estate, this is actually unlikely to happen. There is never a situation where dying intestate is preferable to writing a Will.

Living Trust:

There are many reasons why you may want to prepare a Living trust. A Living Trust allows you to pass assets onto another person while you are still alive. But the trust protects the assets, so the recipient cannot access them immediately.

One of the most common uses is to reduce the size of an estate and thereby reduce probate fees. Probate fees are typically a percentage of the estate, so a reduction in the size of the estate can be a money saver. The specifics of trust law differ internationally. Also called “inter vivo,” Latin for “between the living.”

Living Wills:

This is perhaps the most unfortunately named estate planning document, and is a term that industry experts are trying to phase out. Your Living Will usually does a couple of different things. Firstly, it allows you to express the type of healthcare you wish to receive if you were ever in an irreversible terminal condition. It also allows you to name a specific individual who can make healthcare decisions on your behalf if you are unable to speak for yourself. The Living Will has absolutely nothing to do with your Last Will and Testament which only comes into effect after you have died (the Living Will is in effect while you are alive and is no longer in effect once you die).

Probate:

The legal process which legitimizes Wills after the death of the testator. The probate process generally empowers the executor to distribute the estate. There is a common fear of probate, particularly in the US. And many people feel it is something you should avoid at all costs. However, in reality, probate is simply the process that allows the courts to establish the authenticity of the Will. It also grants your Executor the authority to act as your estate administrator.

If there was no probate process, your Executor would have to present themselves at a bank with a Will asking for the contents of an account. But the bank cannot validate the Will, or know whether it is indeed the Last Will and Testament.

By probating the Will, the Executor receives a document called a grant of administration, and it is this document that the Executor uses to gather up the assets of an estate.

Testator:

The person expressing their last wishes in a Last Will and Testament. If you write a Will, you are the testator in that Will.

Trust:

A property holding on behalf of a person (usually family trusts) or organization (usually charitable trusts). If you include a trust in your Will, it is a “testamentary trust”. Trusts in Wills are commonly set up for minor beneficiaries, who cannot legally inherit until they are adults. A trustee has the responsibility to manage the inheritance until the child is old enough to receive the funds directly.

You can use a Will to set up Lifetime interest trusts. For example, many Wills allow a second spouse to make use of the family home for the rest of their life. But once they die, the house passes to the children.

Witness:

A person over the age of eighteen (or nineteen in some jurisdictions) who confirms that the testator was of sound mind and acting of their own volition rather than under duress. Witnesses do not necessarily have to be aware of the specific contents of the Will in order to sign it. They simply have to sign to say that the testator knew what they were doing. They also verify that nobody was unduly influencing the signing process.

Hopefully this is a good start.

Are there any other definitions you would like to see? we are happy to add more.

- Am I too young to write a Last Will and Testament? - May 25, 2017

- Confused about Wills? Unusual expressions demystified. - July 21, 2016

- How to write a legal Will – the signing process - May 20, 2016